1031 Exchange Services

We Assist You in Finding a Qualified Intermediary

Start an Exchange Today

What is a 1031 Exchange?

Under Section 1031 of the United States Internal Revenue Code, a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchange.

To put it simply, this strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long another “like-kind property” is purchased with the profit gained by the sale of the first property.

Contact us today to learn more about 1031 Exchange Services.

Why do 1031 Exchange?

With the strong economic growth and property appreciation that we have seen in many areas throughout the county over the past several years, it makes good sense. Aside from giving the investor a tremendous increase in purchasing power, a 1031 exchange can also provide the benefits of leverage, consolidation, diversification, management relief, and increased cash flow and income.

Our services

Find Qualified

Intermediaries

Trying to find a qualified intermediary is no easy feat. For starters, a successful 1031 Exchange is not a do-it-yourself project. We can assist you in finding a qualified intermediary.

We Sell Your Current Investment Property

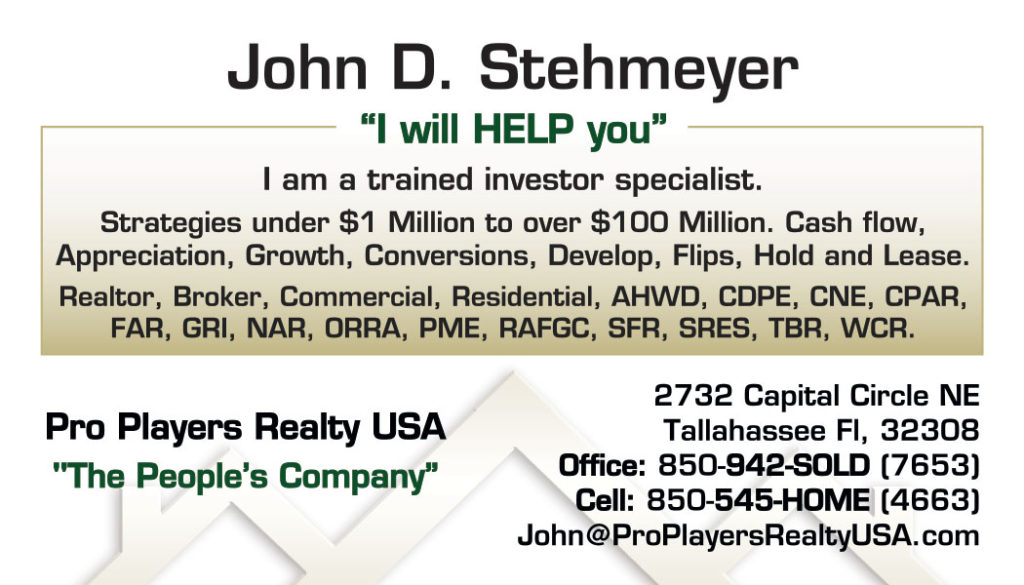

We are Realtors specializing in Commercial Real Estate, Real Estate Franchises, & provide one of a kind Real Estate Business opportunities for agents. All our agents have a dedicated team working with them to assist you with your real estate needs.

Acquire New Investment Properties

We can help you transform your current properties into things that perform better for you. We have a investor specialist on staff whose expertise lies in strategies under $1M to over $100M, Cash Flow, Appreciation, Growth, Conversions, Developments, Flips, Hold and Lease.

Start an Exchange Today

Learn About Our 1031 Exchange Services

Call Us Today with Any Questions

Contact Us For More Info!